Page 110 - 2024.2025 - 澳門理工大學研究生課程手冊 (電子書)

P. 110

ENGLISH

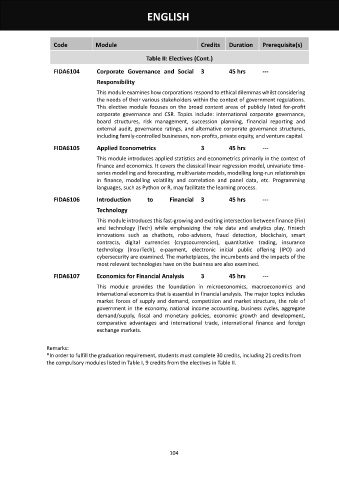

Code Module Credits Duration Prerequisite(s)

Table II: Electives (Cont.)

FIDA6104 Corporate Governance and Social 3 45 hrs ---

Responsibility

This module examines how corporations respond to ethical dilemmas whilst considering

the needs of their various stakeholders within the context of government regulations.

This elective module focuses on the broad content areas of publicly listed for-profit

corporate governance and CSR. Topics include: international corporate governance,

board structures, risk management, succession planning, financial reporting and

external audit, governance ratings, and alternative corporate governance structures,

including family-controlled businesses, non-profits, private equity, and venture capital.

FIDA6105 Applied Econometrics 3 45 hrs ---

This module introduces applied statistics and econometrics primarily in the context of

finance and economics. It covers the classical linear regression model, univariate time-

series modelling and forecasting, multivariate models, modelling long-run relationships

in finance, modelling volatility and correlation and panel data, etc. Programming

languages, such as Python or R, may facilitate the learning process.

FIDA6106 Introduction to Financial 3 45 hrs ---

Technology

This module introduces this fast-growing and exciting intersection between finance (Fin)

and technology (Tech) while emphasizing the role data and analytics play. Fintech

innovations such as chatbots, robo-advisors, fraud detection, blockchain, smart

contracts, digital currencies (cryptocurrencies), quantitative trading, insurance

technology (InsurTech), e-payment, electronic initial public offering (IPO) and

cybersecurity are examined. The marketplaces, the incumbents and the impacts of the

most relevant technologies have on the business are also examined.

FIDA6107 Economics for Financial Analysis 3 45 hrs ---

This module provides the foundation in microeconomics, macroeconomics and

international economics that is essential in financial analysis. The major topics includes

market forces of supply and demand, competition and market structure, the role of

government in the economy, national income accounting, business cycles, aggregate

demand/supply, fiscal and monetary policies, economic growth and development,

comparative advantages and international trade, international finance and foreign

exchange markets.

Remarks:

*In order to fulfill the graduation requirement, students must complete 30 credits, including 21 credits from

the compulsory modules listed in Table I, 9 credits from the electives in Table II.

104