Page 108 - 2024.2025 - 澳門理工大學研究生課程手冊 (電子書)

P. 108

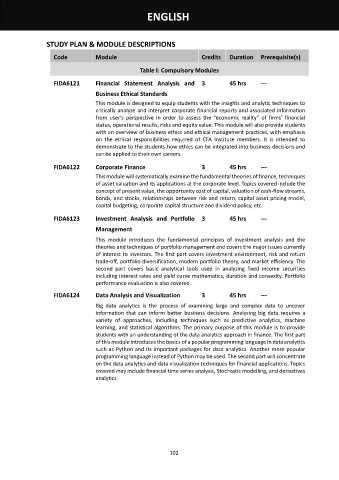

ENGLISH

STUDY PLAN & MODULE DESCRIPTIONS

Code Module Credits Duration Prerequisite(s)

Table I: Compulsory Modules

FIDA6121 Financial Statement Analysis and 3 45 hrs ---

Business Ethical Standards

This module is designed to equip students with the insights and analytic techniques to

critically analyze and interpret corporate financial reports and associated information

from user’s perspective in order to assess the “economic reality” of firms’ financial

status, operational results, risks and equity value. This module will also provide students

with an overview of business ethics and ethical management practices, with emphasis

on the ethical responsibilities required of CFA Institute members. It is intended to

demonstrate to the students how ethics can be integrated into business decisions and

can be applied to their own careers.

FIDA6122 Corporate Finance 3 45 hrs ---

This module will systematically examine the fundamental theories of finance, techniques

of asset valuation and its applications at the corporate level. Topics covered include the

concept of present value, the opportunity cost of capital, valuation of cash-flow streams,

bonds, and stocks, relationships between risk and return, capital asset pricing model,

capital budgeting, corporate capital structure and dividend policy, etc.

FIDA6123 Investment Analysis and Portfolio 3 45 hrs ---

Management

This module introduces the fundamental principles of investment analysis and the

theories and techniques of portfolio management and covers the major issues currently

of interest to investors. The first part covers investment environment, risk and return

trade-off, portfolio diversification, modern portfolio theory, and market efficiency. The

second part covers basic analytical tools used in analyzing fixed income securities

including interest rates and yield curve mathematics, duration and convexity. Portfolio

performance evaluation is also covered.

FIDA6124 Data Analysis and Visualization 3 45 hrs ---

Big data analytics is the process of examining large and complex data to uncover

information that can inform better business decisions. Analysing big data requires a

variety of approaches, including techniques such as predictive analytics, machine

learning, and statistical algorithms. The primary purpose of this module is to provide

students with an understanding of the data analytics approach in finance. The first part

of this module introduces the basics of a popular programming language in data analytics

such as Python and its important packages for data analytics. Another more popular

programming language instead of Python may be used. The second part will concentrate

on the data analytics and data visualization techniques for financial applications. Topics

covered may include financial time series analysis, Stochastic modelling, and derivatives

analytics.

102