Page 267 - 22-23_Undergraduate_Prospectus

P. 267

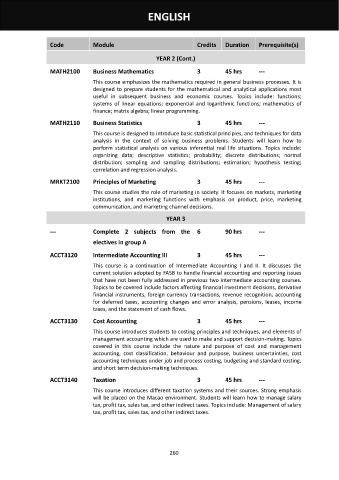

ENGLISH

Code Module Credits Duration Prerequisite(s)

YEAR 2 (Cont.)

MATH2100 Business Mathematics 3 45 hrs ---

This course emphasizes the mathematics required in general business processes. It is

designed to prepare students for the mathematical and analytical applications most

useful in subsequent business and economic courses. Topics include: functions;

systems of linear equations; exponential and logarithmic functions; mathematics of

finance; matrix algebra; linear programming.

MATH2110 Business Statistics 3 45 hrs ---

This course is designed to introduce basic statistical principles, and techniques for data

analysis in the context of solving business problems. Students will learn how to

perform statistical analysis on various inferential real life situations. Topics include:

organizing data; descriptive statistics; probability; discrete distributions; normal

distribution; sampling and sampling distributions; estimation; hypothesis testing;

correlation and regression analysis.

MRKT2100 Principles of Marketing 3 45 hrs ---

This course studies the role of marketing in society. It focuses on markets, marketing

institutions, and marketing functions with emphasis on product, price, marketing

communication, and marketing channel decisions.

YEAR 3

--- Complete 2 subjects from the 6 90 hrs ---

electives in group A

ACCT3120 Intermediate Accounting III 3 45 hrs ---

This course is a continuation of Intermediate Accounting I and II. It discusses the

current solution adopted by FASB to handle financial accounting and reporting issues

that have not been fully addressed in previous two intermediate accounting courses.

Topics to be covered include factors affecting financial investment decisions, derivative

financial instruments, foreign currency transactions, revenue recognition, accounting

for deferred taxes, accounting changes and error analysis, pensions, leases, income

taxes, and the statement of cash flows.

ACCT3130 Cost Accounting 3 45 hrs ---

This course introduces students to costing principles and techniques, and elements of

management accounting which are used to make and support decision-making. Topics

covered in this course include the nature and purpose of cost and management

accounting, cost classification, behaviour and purpose, business uncertainties, cost

accounting techniques under job and process costing, budgeting and standard costing,

and short term decision-making techniques.

ACCT3140 Taxation 3 45 hrs ---

This course introduces different taxation systems and their sources. Strong emphasis

will be placed on the Macao environment. Students will learn how to manage salary

tax, profit tax, sales tax, and other indirect taxes. Topics include: Management of salary

tax, profit tax, sales tax, and other indirect taxes.

260